Investing in Women’s Financial Inclusion makes Economic Sense: Women’s World Banking’s Jan Dhan Plus Programme Evidence

Making Finance Work for Women: India Edition brought together former bureaucrats, technocrats, financial sector, and civil society representatives to discuss approaches to scale financial inclusion in India.

Jan Dhan Plus programme has now been rolled out to 512 branches with over 5 million PMJDY account holders, of which an estimated 2.3 million are women customers

~ When Banks invest in business correspondents there is a 2X increase in deposit mobilisation and cross-sell of Jan Suraksha (insurance and pension) schemes.

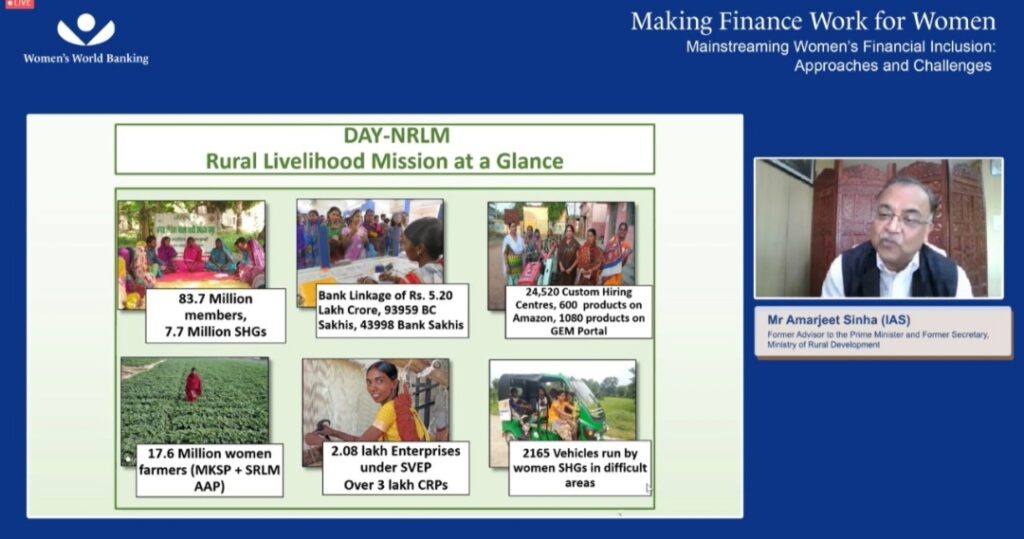

New Delhi: Women’s World Banking organised the second edition of their flagship thought-leadership series “Making Finance Work for Women” (MFWW) on September 28, 2022 to discuss approaches to scale women’s financial inclusion in India. This virtual event also discussed the outcomes from the Jan Dhan Plus Programme rolled out with Bank of Baroda in rural and peri-urban areas. Mr Amarjeet Sinha, former advisor to the Prime Minister and former secretary of the Ministry of Rural Development, was the keynote speaker at the event. He said “The quest to find an answer to how we can achieve a reduction in poverty has been a long-pressing one, and that brought us to the Making Finance Work for Women virtual event. Our years of work in rural India have found that confident women can truly run local economies, and the return on investing in women has consistently been higher. Members of women’s Self-Help Groups have proved to be effective enterprises in helping women’s needs. Their community-connect and social capital must be leveraged for the path forward. Change and transformation happen when finances work for women, and I’d like to congratulate bankers for bridging the gap in gender inclusion in finance to a substantial extent.”

A panel discussion on Mainstreaming Women’s Financial Inclusion featured Sanjiv Chadha, MD and CEO, Bank of Baroda, Rajesh Bansal, CEO, Reserve Bank Innovation Hub (RBIH), Kalpana Ajayan, Regional Head of South Asia, Women’s World Banking, and Jayshree Vyas, MD, Sewa Sahakari Bank Ltd.

Kalpana Ajayan, Regional Head-South Asia, Women’s World Banking, said, “India’s focus on financial inclusion has provided the requisite impetus to bring the unbanked segment into formal banking. Women-centered design approach, that is based on insights, when adopted across the value chain and by the entire ecosystem, can encourage women to better engage with financial products and services. Through our partnerships with India’s large public sector banks, regulators, national programmes, civil society organisations and fin-tech players, we are confident that the next half billion will be financially empowered.

Women’s World Banking, in partnership with Bank of Baroda, launched the Jan Dhan Plus solution programme in urban areas of Chennai, Delhi, and Mumbai in 2019. The Jan Dhan Plus model rests on 3 core pillars: Making the bank ecosystem a welcoming one for low-income women; making savings relatable and rewarding for women; and building the soft skills of Business Correspondents with a gender-focus to make them better understand and fulfil the needs of women customers. After piloting this in Uttar Pradesh’s Shahjahanpur Region in March of 2022, this was rolled out to the entire zone (512 branches, over 5 million PMJDY account holders, estimated 2.3 million women customers, 2024 bank agents, and 1476 Bank Sakhis). The learnings and outcomes from the peri-urban and rural programme were shared at this event.

Speaking from the Jan Dhan Plus experience, Mr Sanjiv Chadha, MD and CEO of Bank of Baroda, said, “Today 56 percent of PMJDY accounts belong to women, this is encouraging, but we need to go beyond and go farther to reach every woman and young adult. More importantly, we need them to engage with their accounts, not just for DBTs or savings, but even for pension, insurance, credit, etc. Jan Dhan Plus has been an interesting trial that started off in 2020 in urban cities for low-income women and was then rolled out in rural areas. Through our partnership with Women’s World Banking we have focussed on strengthening capacities, pursuing a gender intentional approach and making our ecosystem gender sensitive to be able to better serve our women customers.“

Speaking at the event, Mr Rajesh Bansal, CEO, Reserve Bank Innovation Hub said, “India is poised to be the hub of fintech in the future and women’s financial inclusion requires deploying innovation in financial services. RBIH’s Swanari was established to encourage more women founded innovations that aim to solve for the financial needs of women. RBIH is also working towards gender-intelligent banking that could catalyse women’s financial inclusion.”

Ms Jayshree Vyas, SEWA Bank said, “SEWA Bank’s approach of providing financial services and financial, digital and entrepreneurship training lead to overall socio-economic development of these women members. SEWA Bank’s self-employed women members are economically active, brave, hardworking, risktakers, learning continuously and implementing their learning for their overall financial wellbeing.”

The speakers agreed that we need to target policies and initiatives that address systemic barriers to women’s social and economic participation; increase adoption of innovation and technology in the sector; and invest in customer protection as we scale.